According to an article appearing in The Advocate, the White House is asking Congress to bar the National Flood Insurance Program (NFIP) from issuing new policies to cover new homes or business in any flood zone.

White House budget director Mick Mulvaney, in a letter to Senate Majority Leader Mitch McConnell, R-Kentucky, says the program is “simply not fiscally sustainable in its current form” and outlines several other potentially significant changes to its rules.”

The Insurance Journal claims that the program was $24.6 billion in debt as of 18 September 2017. Under current law, FEMA can borrow up to $30.4 billion from the Treasury to operate NFIP, leaving $5.8 billion in remaining borrowing authority. It will blow past this number due to tens of billions of dollars in damages and claims resulting from Harvey, Irma, and Maria.

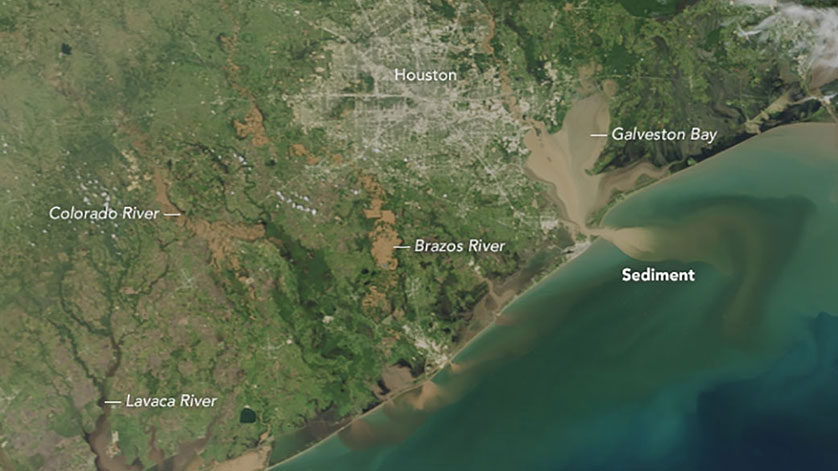

This fits the overall trend, in which the agency estimates that the shortfall for the NFIP program stems from premiums falling short of expected costs in coastal counties, rather than in inland counties. The Congressional Budget Office (CBO) is on record saying that coastal counties are being undercharged for insurance.

“The result is that most policyholders whose property is at risk of wave damage from storm surges do not pay premiums that cover their expected costs. Instead, the additional expected costs from wave damage are spread broadly among the NFIP’s policyholders, resulting in a cross-subsidy from inland counties (on average) to coastal counties: That is, some of the expected costs associated with coastal policies are covered by higher premiums paid by policyholders in inland counties,” CBO said in a report written before Hurricanes Harvey, Irma, and Maria hit the United States.

Congress has a December 8 deadline to reauthorize the program, and write off the billions of dollars that the program owes the U.S. Treasury. If the debt is not forgiven, then the program will have to borrow from the Treasure to make payments. Currently, the interest payments on these loans are passed on to policy holders and raise rates no matter where you live.

White House budget director Mulvaney called for lawmakers to maintain subsidized insurance rates for low-income homeowners but called for pairing that with “accelerated premium increases for policyholders who can afford to pay risk-based rates.”

The White House is also pushing for more authority for the government to cancel policies on properties that have flooded more than once.

More than 30,000 “severe repetitive loss” properties have been insured through the federal program, according to a study of FEMA data the Natural Resources Defense Council released in July. The properties have flooded an average of five times, on average every two to three years, and are the most flood-prone homes in the program.

An article in Bloomberg stated, “Trump’s plan would radically overhaul the program created in 1968 to help protect homeowners who live along coasts or near rivers. The idea, sent by the White House to Congress, created an unlikely set of responses: Home builders warned it could stifle the economy while climate activists, who have battled Trump, called the idea smart.”